Cryptocurrency

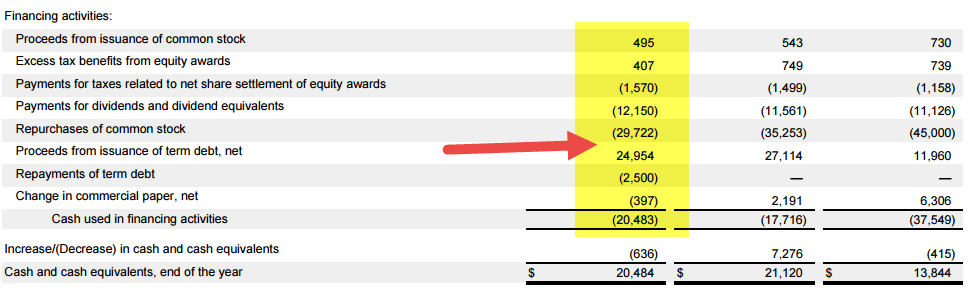

Buy shares in prime rental properties and manage your diversified portfolio online through our mobile app and web platform. This is your personal data and you can tell ushow you want your data to be used as explained here. The difference between the index performance and the fund performance is called the “tracking error”, or, colloquially, “jitter. It provides a way for firms to increase cost effectiveness and reduce their minimum investment requirement. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide market liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Professional Gold IRA firms can assist you in opening a new account, selecting precious metals, deciding on storage options, locating a capable custodian, and providing information and assistance. You can sign up to the platform today here. Federal government websites often end in. Positive cash flow indicates that a company’s liquidity position is strong or increasing; negative cash flow indicates that a company’s liquidity position is weak or shrinking. The other apps on this list all shine on one or two key points, like automated saving and investing features or beginner friendliness. 10 Biggest Energy Companies in the UK. When you buy or sell an ETF, you do so from another market participant, not the fund company. Volatility profiles based on trailing three year calculations of the standard deviation of service investment returns.

Acorn International Inc ATV

According to Warhurst 1998. A type of investment with characteristics of both mutual funds and individual stocks. In no event will AQR be responsible for any information or content within the linked sites or your use of the linked sites. We’ve all seen people make a fortune on appreciation or heard about people who went from being deep in debt to millionaires using no money down strategies. The IRS does not allow jewelry, even though it may hold significant value. Credit and equity markets are symbiotic but not always efficient. We all want the best for the little people in our lives and investing for your children is a great way to set them up for the future. Bankrate’s editorial team writes on behalf of YOU – the reader. Investing involves risk, including risk of loss. Now the Rise Fund and the Bridgespan Group have developed what they call the impact multiple of money IMM to demonstrate the value of putting impact underwriting on the same footing as financial underwriting. We are very pleased with Interhouse and have also hired Bas to handle our own affairs with regard to our investment property. Wholesaling is the most popular strategy taught by real estate gurus. Let’s take Greg as an example.

How Much Money Do I Need to Buy Cryptocurrency?

Investors receive a higher interest rate from investing in junk bonds for assuming the higher risk of these debt securities. Mon Fri: 8:30 am 9:30 pm. Marketing mix: Pick an approach based on business needs, data availability, and analytical preferences and stick to it. The first cryptocurrency was Bitcoin, which was founded in 2009 and remains the best known today. I have to agree with the negative comments. These products give investors a simple way to build a diversified investment portfolio across a wide range of asset classes and investment strategies. Our extensive equity and fixed income capital markets research teams provide superior, profound expertise to institutions. Silver bars can come in many sizes but the most popular sizes for investors are the 10 ounce silver bar and the 100 ounce silver bar. We offer a wide range of fixed income solutions, including money market funds and annuities, designed to serve different investment needs. Housers is a crowdfunding platform authorized and regulated in Spain by CNMV registered under number 20 and in Portugal, by CMVM. Sélectionnez un autre emplacement. He has sold more than 400,000 books worldwide. Robinhood, Under the Hood Blog. The Ultimate Guide to Investing. You could lose all your money invested if you don’t have proper risk management strategies. Spreading your investments smartly through diversification gives you options – and it’s completely within your control. Provides exposure to shorter maturity investment grade debt securities believed to have positive ESG benefits. And investing may give you tax advantages. This material was published in February 2023 and has been prepared for informational purposes only, and is not a solicitation of https://daily-bb.com/free-cinema-hall/ any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. As a jumping off point, here are some quick tips for buying your first property. As a leading equity broker dealer, we deliver objective, independent advice, exceptional service and superior execution that support you as you navigate the markets. To achieve this two fold goal, many retirement account holders are seeking to invest in alternative assets — assets outside of stocks, bonds, mutual funds, ETFs and CDs — that are the traditional investments allowed in retirement accounts. You choose how often you plan to contribute weekly, bi weekly, monthly, semi annually and annually in order to see how those contributions impact how much and how fast your money grows. As a result, we can free you from high order commissions through our efficient structures.

Annual Charge

Personal Advisor offers ongoing personal financial planning and automated investing options with access to an advisor. If you buy a stock and it increases in value, the capital gains are the difference between your purchase price and sale price,” says Klaff. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Vanguard Digital Advisor’s services are provided by Vanguard Advisers, Inc. Most equity investors own publicly traded common stock. Persons who are not Eligible Persons, including but not limited to those individuals or other persons who fall within the FCA’s definition of ‘retail clients’, should not use or rely upon this website or the information contained therein and may not engage the services of Principal Real Estate or any of its affiliates, or invest in any Fund. Their expertise and commitment to excellence make them one of the top gold IRA companies, providing customers with a safe and secure way to invest in gold. Should you lose this password, your Bitcoin will also be lost and can never be retrieved. Having that understanding is very important when it comes to assessing investment choices yourself. Morgan Stanley creates all the portfolios and does the due diligence on the funds and managers they use for the ETFs, mutual funds, and cash investment strategies that make up the portfolio. Our website is completely free for you to use but we get paid by lenders, brokers, and service providers for introductions and funded applications. Robo advisors like Betterment or Wealthfront also have way more portfolio selection and customization available than Acorns’ five portfolios. It is not the sort of investment to use to build your savings.

2 Interactive Brokers

The resulting graph for r/Investing is a graph of 116,696 nodes and 3,803,470 edges; and for r/WallStreetBets a graph of 300,604 nodes and 11,616,316 edges. MandG plc is the direct parent company of The Prudential Assurance Company Limited. This story will evolve over years, as leases expire and mortgages mature. Apart from renting thoseproperties, investors can also look at opportunities with crowdfunding, andmany also opt for REIT real estate investment trust where they buy shares. Risk level: Low to medium. Transparency – the full portfolios of ETFs are made available to investors daily. Investors buy a share in the fund and in doing so, they invest in all of the fund’s holdings with one transaction. It can be tempting to invest large amounts into high risk assets, but this can be crippling, especially for long term investors. What’s more, these portfolios were created by experts to suit most investors’ wishes, so they’re worth checking out. At that stage please press the “Invest Now” button. Making money in the stock market is easier than keeping it, with predatory algorithms and other inside forces generating volatility and reversals that capitalize on the crowd’s herd like behavior. ✍️ Sign up to the Whitelist today and join us in getting the $ESX Token to Mars⭕️. Your most important financial step for 2023. Click the “View Report” button for a detailed look at the results. Why short duration bonds.

2 Stellar Lumens XLM

$5 Investment minimum. Investors buy the bonds, then the company pays them back, plus a percentage of interest, over time. This app provides professionally managed portfolios using select ETFs that are individually matched with your risk tolerance and targeted cash out date. The value of investments may go up or down and is not guaranteed. Examples of the main platforms include CrowdStreet, RealCrowd and Fundrise, to name but a few. SandP Index data is the property of Chicago Mercantile Exchange Inc. These deals typically require longer commitments from investors and offer a different set of risk reward profiles compared to buying shares in established income producing rental properties. 3This strategy includes ETFs that focus on companies known for incorporating socially responsible investing criteria, sometimes referred to as “environmental, social, and governance “ESG” investing; screening for companies that adhere to ESG standards; or fixed income ETFs focused on community impact securities. You may leave this website when you access certain links on this website. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy.

Portfolio diversification

As real estate values and prices fluctuate, so do returns on real estate investments. The user can compare investment returns for similar or different asset classes. ROI and Business Tech Investment. This strategy uses the groundbreaking G–Score research as well as AAII’s proprietary Growth Grade designed to identify stocks with consistent growth potential. Participants include employees from companies like. Multiple leg options strategies will involve multiple commissions. Students are not equipped for this change. Here’s how much money the average middle class American household makes — how do you stack up.

Privacy Settings

CBD Investr is available for all the residents of the UAE. Active shareholders can exercise their voting rights at shareholders’ meetings. Alternatively, you can hold onto it and receive regular payments called dividends. After you download the app, you can connect it to your bank account. In venture philanthropy, it involves the syndication of an investment into a social purpose organisation, by other funders e. Background and qualification information is available at FINRA’s BrokerCheck website. A licensed financial adviser will consider your personal situation and make a recommendation suitable to your financial needs. This audiobook is a comprehensive guide to understanding and generating passive income. Even worse, investors can get trapped into deceitful deals that only serve their greedy community. BlackRock Investment Management UK Limited is not licensed as, a portfolio manager, investment adviser or investment manager under the Investment Marketing and Investment Portfolio Management Law 1995 the “Advice Law” or any other applicable law, nor does it carry insurance as required thereunder. Leveraged ETFs effectively increase exposure ahead of a losing session and decrease exposure ahead of a winning session. The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested. That return of capital to investors has been a key strategy in real estate investing. A cash flow analysis helps assess current cash flows. On the flip side, the responsibilities and management skills required to run an SMSF are significant. If you’re new to rental property and have never owned a home yourself, you don’t know what to look for when spotting problems or potential problems with a home. “For many, investing is a way to help pay mortgages and receive tax write offs in the short term, and an appreciating investment in the long term. Slow and steady wins the race. Chris Voss teaches simple, practical negotiating tools and methods you can instantly put to work with immediate results. A comfortable retirement usually requires an IRR of 60 to 70 per cent although those who live simply may aim for just 50 per cent, and some ambitious people may even aim for 110 per cent. To read this article and more news on Reddit, register or login. PLEASE CHECK OUT THE ENTIRE LESSON LIST BELOW. First, I assume the text will improve as new editions are developed with the iPad in mind. I vividly remember being a beginner real estate investor. They do not represent, offer, or compare products and services of other financial services organizations. Our deep macroeconomic and microeconomic research incorporates analysis of economic, demographic, political, technological, property, and capital market trends. Ownership in only one company because it will be easier to create a diversified account using funds if the account in question is small. TechTarget’s survey of IT professionals underlines the continued importance of security and cloud initiatives, as well as. We were one of the first private banks to focus on sustainable investments and are continuously expanding our sustainable investing activities.

U S Energy Has Been Featured In

BP’s commitment from February 2020 to reduce all emissions from the oil and gas that the company produces to net zero by 2050 is a prominent case in point. For full disclosures, please reference the Socially Responsible Investing Portfolios Disclosure. “Interest in ESG has only been more pronounced since 2020 due to the pandemic and renewed focus on racial equality,” says Kevin McDevitt, director of global manager research for RBC Wealth Management U. Outstanding blend of tools and pricing compared to competition. The qualitative analysis and quantitative analysis of different companies. Fixed rates are great to reduce risk, but once you’re locked in, you can’t increase the rate. Acorns offers two tiers of service – Personal and Family – each of which gives you a type of investing account at a different monthly price point $3 and $5, respectively. Rental Income: Some real estate investors will rely solely on value appreciation. We continue to refine and deepen our approach and Firm resources to create value through our investments. Interactions are part of an investor’s life, so the faster you can overcome this fear, the more successful you’ll be. Since the investor owns 1,000 shares of Apple, he would’ve received $8,000 in cash if he was not enrolled in the dividend reinvestment plan. Despite the potential difficulty of determining the ROI of a specific investment, the metric is still very useful when trying to ensure you earn more than you spend. John Schaub walks through how he started with nothing and built an entire portfolio of rental properties. These commercial property investments average a 2.

What You Get:

While income investing is often viewed as a way to create income for retirement, that’s not always the case. What’s more, against a backdrop of potentially elevated inflation and higher interest rates, Morgan Stanley’s Global Investment Committee forecasts muted returns for those asset classes over the next several years. The funds are not required to file a prospectus or registration statement with the SEC, and accordingly, neither is available. Learn what it takes to achieve a good credit score. Having some great go to resources to stay informed about the stock market is key. Take a deeper dive: Multifamily vs Single Family Real Estate Investing. Does it look more like a legitimate investment opportunity or an investment scam. Chip is a little different from the other apps I’ve chosen on this list. For a small fee and sometimes no minimum initial investment you can receive professionally based portfolio recommendations in minutes. By Vlad Schepkov Mizuho analysts issued a warning to Coinbase NASDAQ:COIN investors, noting that those “excited about Bitcoin’s rally to $30K” could be in “for a rough. Listen on Apple Podcasts HERE. Also, if you have a Wealth Management account, our dedicated concierge team is here to help with all things wealth, plus your other Ally Invest and Ally Bank accounts, too. There are hundreds of different indexes you can track using index funds. Portfolios are based on asset allocation insights from Morgan Stanley’s Global Investment Committee. If a company is struggling, the prices of its bonds on the secondary market might decline in value. Company reputation and reviews are the biggest factor to consider when choosing the top gold IRA companies. BNP Paribas Pesona Syariah. Mutual funds are professionally managed pools of investor funds that focus their investments in different markets. The information provided on the Site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. Learn more here and here. And The Toronto Dominion Bank. “You have to make the most of it.

Invest in vacation homes

But in any case, it’s important to review fees to make sure you’re not paying for anything you plan to do regularly. There is no customization beyond that. Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. All investments carry some level of risk including the potential loss of all money invested. Jim Cramer is one of the most watched analysts, with over 1. Because 3% of VC funding is directed towards women. So, once you buy shares of some great ETFs, the best advice is to leave them alone and let them do what they’re intended to do: produce excellent investment growth over long periods of time. Short, thoughtful and regular takes on recent events in the markets from a variety of perspectives and voices within Morgan Stanley. Impact measurement and management IMM is a process that assesses the social, environmental, and economic impacts of an organization’s activities. Edward Jones’ Canadian advisors may only conduct business with residents of the provinces in which they are registered.

Secured

You can withdraw cash from your Schwab Intelligent Portfolios account at any time by logging in to your account and requesting a transfer. Some of the features of IBKR GlobalTrader include automatic currency conversions, fractional shares, demo account, and more. Fund management charge: 0. These tokens can be used to transact with or pay fees to transact using specific networks. Once you’ve chosen an index, you can generally find at least one index fund that tracks it. This book is intended to providing answers to some of the most commonly asked questions that I have experienced during my many years of real estate consulting and investing in the District of Columbia, Maryland, and northern Virginia. Plus, Business, Leadership, and Management courses. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. This book is the ultimate guide to navigating the world of apartment syndication and building a multimillion or multibillion dollar commercial real estate empire. Their expense ratios are slightly higher than for ETFs, but a brokerage fee is usually required for investor purchases and sales of ETF shares. This is why many investors flock to gold during periods of inflation. Our automated system is available 24 hours a day. To search and apply for jobs, please visit our jobs page. Cramer also will provide articles and videos each day on CNBC’s digital offerings. Whether you run a real estate business, manage property listings or a commercial property, buy and flip foreclosed properties, flipping houses, or manage new rental properties. You like having a professionally managed portfolio for a low cost, along with a cash management account. This section of my RBC Direct Investing vs. Conversely, in periods of economic growth, silver can decline in value as investors turn to other assets that generate higher returns. If you’d rather not build your own portfolio of index funds, you can buy a diversified portfolio containing a combination of four Fidelity stock and bond index funds. Funds and ETFs differ from stocks because of the management fees that most of them carry, though they have been trending lower for many years. With a savings account, you have access to your funds either immediately, or within an agreed timeframe, in case you need to withdraw the money for a specific purpose. It is a collection of many stocks/bonds that is traded under one fund, very similar to Mutual Funds; unlike Mutual Funds however, ETF is traded on the US stock exchanges with real time pricing. A lot of people get confused and think a tax lien sale and a tax deed sale are the same things. Such investments can be a powerful addition to a portfolio “. When you invest, your money can increase or decrease depending on the day to day changes in the market, so there is much more risk. IShares can help create solutions to meet the evolving needs of investors. What Is Impact Investing. If your savings goal is more than 20 years away like retirement, almost all of your money can be in stocks. They have over 60,000 property listings including homes, lands, office spaces, and other commercial properties.